Unlocking the Secrets of Land: A Comprehensive Guide to Tax Map Lookup

Related Articles: Unlocking the Secrets of Land: A Comprehensive Guide to Tax Map Lookup

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Secrets of Land: A Comprehensive Guide to Tax Map Lookup. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Land: A Comprehensive Guide to Tax Map Lookup

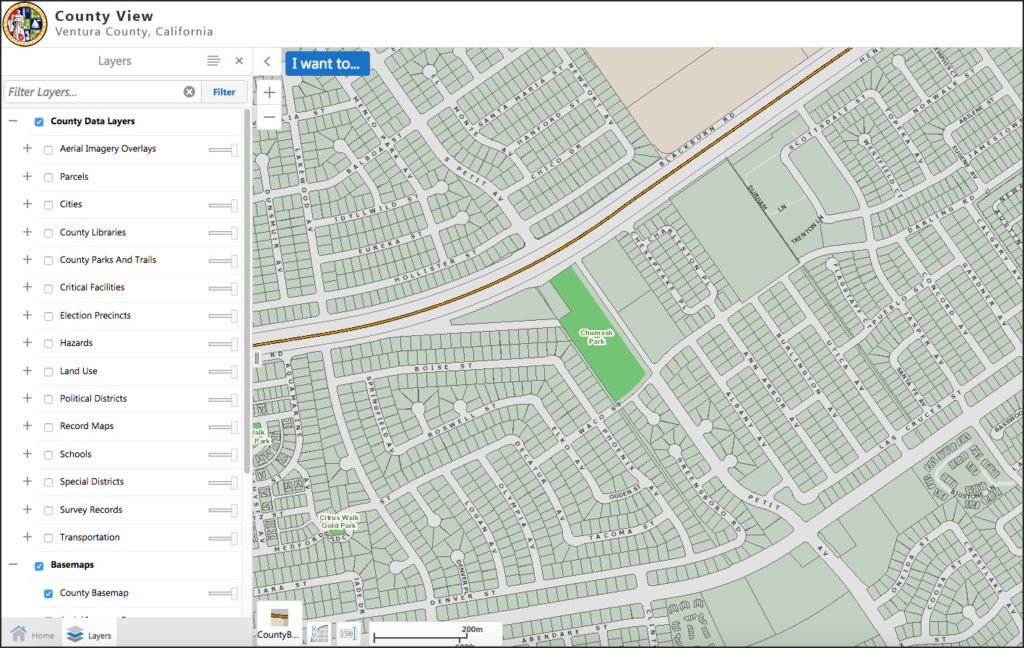

Navigating the complexities of land ownership and property information can be a daunting task. However, a powerful tool exists that simplifies this process: the tax map lookup. This system, employed by local governments across the globe, provides a detailed, organized, and easily accessible record of land parcels within a specific jurisdiction.

Understanding the Foundation: What is a Tax Map?

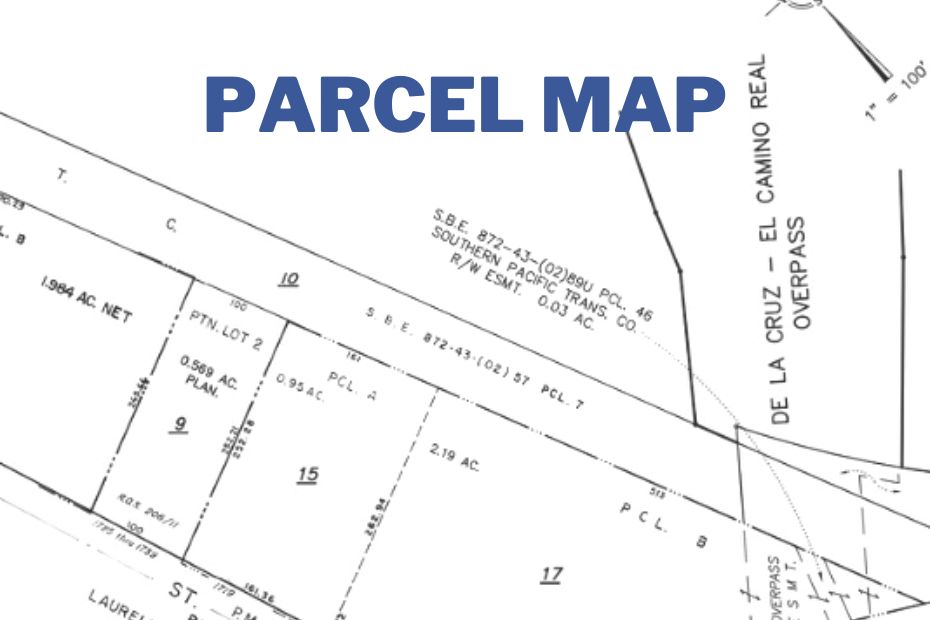

A tax map is a visual representation of a geographic area, typically a county or municipality, divided into distinct parcels of land. These parcels are assigned unique identifiers, often referred to as "tax map numbers," and are depicted on the map with their corresponding boundaries. Each parcel’s information is meticulously documented in a database linked to the map, creating a comprehensive record of property ownership, land use, and other relevant details.

The Benefits of Tax Map Lookup:

- Property Identification: Tax maps serve as a primary tool for identifying specific parcels of land. By using the unique tax map number or a property address, users can locate the corresponding parcel on the map and access its associated information.

- Property Ownership Verification: Tax maps provide a reliable source for verifying property ownership. The database associated with the map contains details about the current owner, including their name, address, and contact information.

- Land Use and Zoning Information: Tax maps often include details about the current land use of a property, such as residential, commercial, or agricultural. This information can be crucial for planning and development purposes.

- Property Value Assessment: Tax maps frequently incorporate property value assessments, which are essential for determining property taxes. These assessments are typically conducted by local assessors and are regularly updated to reflect market fluctuations.

- Property Boundaries and Dimensions: The precise boundaries and dimensions of a property are clearly depicted on the tax map, providing valuable information for surveying, construction, and legal purposes.

- Historical Data and Records: Tax maps often contain historical data, including past ownership records, land use changes, and property value trends. This historical information can be invaluable for research, legal disputes, and property investment decisions.

Accessing Tax Map Information: A User-Friendly Approach

Accessing tax map information has become increasingly convenient with the advent of online platforms. Most local governments now provide interactive tax map viewers that allow users to explore the map, zoom in on specific areas, and access property details with ease. These online tools often include features such as:

- Searchable Databases: Users can search for specific parcels by tax map number, property address, or owner name.

- Interactive Map Navigation: Users can zoom in and out, pan across the map, and view detailed information about individual parcels.

- Printable Maps: Users can print out specific sections of the map or download the entire map for offline use.

- Downloadable Data: Some platforms allow users to download property information in various formats, such as spreadsheets or GIS data.

Navigating the Process: A Step-by-Step Guide

- Identify the Relevant Jurisdiction: Determine the county or municipality where the property is located.

- Locate the Tax Map Website: Search online for the website of the local government responsible for property taxes. Most jurisdictions will have a dedicated section for tax maps and property information.

- Access the Interactive Map Viewer: Navigate to the tax map viewer section of the website.

- Input Search Criteria: Use the search function to locate the specific parcel of interest. You can typically search by tax map number, property address, or owner name.

- View and Download Information: Once the parcel is located, you can view its details, including ownership information, land use, property value, and boundaries. You may also have the option to download this information in various formats.

FAQs About Tax Map Lookup:

Q: What is the purpose of a tax map?

A: Tax maps serve as a comprehensive and organized record of land parcels within a specific jurisdiction. They facilitate property identification, ownership verification, and assessment for tax purposes.

Q: How do I find the tax map number for a specific property?

A: You can typically find the tax map number by searching online for the property’s address on the local government’s tax map website. The tax map number will be displayed alongside the property’s other information.

Q: What information is included on a tax map?

A: Tax maps typically include property boundaries, ownership information, land use, property value assessments, and other relevant details.

Q: Are tax maps always accurate?

A: While tax maps strive for accuracy, errors can occur. It’s crucial to verify information obtained from tax maps with other sources, such as deeds or surveys, to ensure accuracy.

Q: Can I use a tax map to determine the value of a property?

A: Tax maps often include property value assessments, but these assessments may not accurately reflect the current market value. It’s recommended to consult with a real estate professional for a more accurate valuation.

Q: What are the benefits of using a tax map lookup?

A: Tax map lookups provide a convenient and accessible way to identify properties, verify ownership, access land use information, and obtain property value assessments.

Tips for Effective Tax Map Lookup:

- Start with the Correct Jurisdiction: Ensure you are using the tax map website for the correct county or municipality where the property is located.

- Use Multiple Search Criteria: For better results, try searching using a combination of property address, tax map number, and owner name.

- Verify Information: Always double-check information obtained from tax maps with other sources to ensure accuracy.

- Contact the Local Assessor’s Office: If you have any questions or need further assistance, contact the local assessor’s office for guidance.

Conclusion:

Tax map lookup is an invaluable tool for individuals and businesses involved in real estate transactions, property management, planning, and development. By providing a comprehensive and organized record of land parcels, tax maps simplify property identification, ownership verification, and land use analysis. With the increasing availability of online platforms, accessing tax map information has become more convenient and user-friendly than ever before. By understanding the functionality and benefits of tax map lookup, individuals and organizations can navigate the complex world of land ownership with greater ease and accuracy.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Land: A Comprehensive Guide to Tax Map Lookup. We thank you for taking the time to read this article. See you in our next article!