Navigating the Landscape of Rural Homeownership in Ohio: Understanding USDA Loan Eligibility

Related Articles: Navigating the Landscape of Rural Homeownership in Ohio: Understanding USDA Loan Eligibility

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Rural Homeownership in Ohio: Understanding USDA Loan Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Rural Homeownership in Ohio: Understanding USDA Loan Eligibility

The United States Department of Agriculture (USDA) Rural Development program offers a valuable resource for individuals seeking to purchase homes in rural areas. Specifically, the USDA Rural Housing Service (RHS) provides loan programs designed to make homeownership more attainable in eligible rural areas. Understanding the program’s eligibility criteria is crucial for potential borrowers. This article will delve into the intricacies of USDA loan eligibility in Ohio, providing a comprehensive overview of the program’s key features, benefits, and requirements.

Defining Rural Ohio: Delving into Eligibility Zones

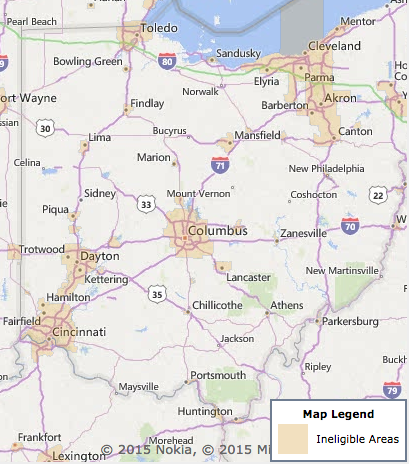

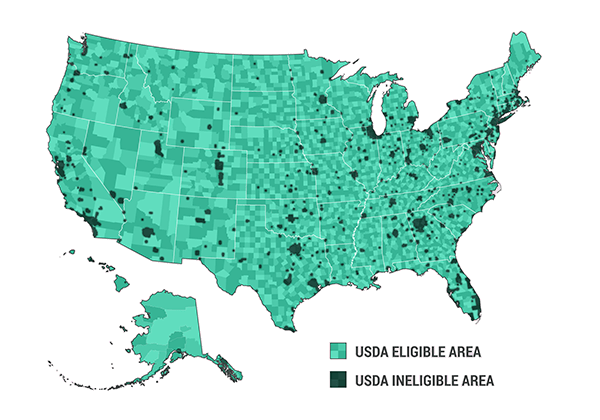

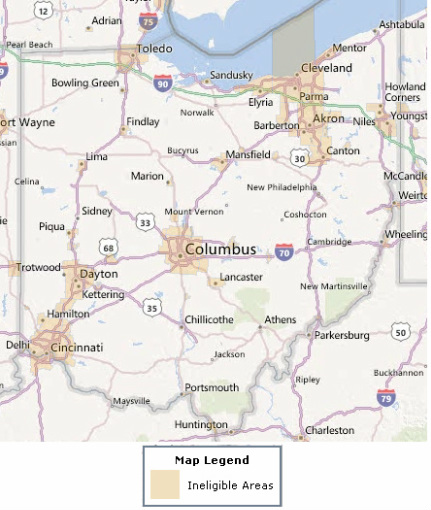

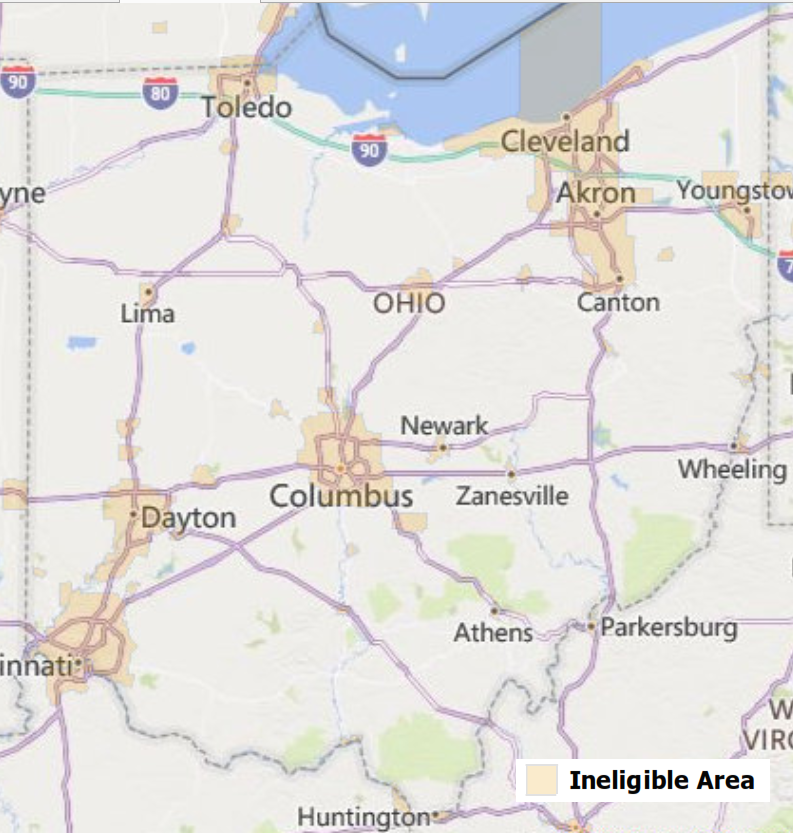

The USDA Rural Development program utilizes a specific definition of "rural" to determine eligible areas. This definition goes beyond simply classifying areas as "rural" or "urban". The program considers various factors, including population density, proximity to urban centers, and the availability of essential services.

The USDA maintains an online mapping tool that allows potential borrowers to check their eligibility based on their location. This tool, known as the "USDA Loan Map", is a vital resource for anyone considering a USDA loan. By inputting an address, users can instantly determine if the property falls within a designated USDA-eligible area.

Benefits of USDA Loans in Ohio

USDA loans offer several distinct advantages for eligible borrowers in Ohio:

- Lower Down Payment Requirements: USDA loans typically require a minimal down payment of 0%, making homeownership more accessible to individuals with limited savings.

- Competitive Interest Rates: USDA loans often feature competitive interest rates compared to conventional loans, helping borrowers save on monthly mortgage payments.

- Flexible Credit Requirements: The USDA program offers more flexibility in credit requirements compared to conventional loans, allowing borrowers with less-than-perfect credit history to qualify.

- Limited Closing Costs: USDA loans can help reduce closing costs, further easing the financial burden associated with purchasing a home.

- Focus on Rural Development: USDA loans play a crucial role in supporting rural communities by promoting homeownership and economic growth in these areas.

Eligibility Criteria: Navigating the Requirements

While USDA loans offer significant advantages, it’s important to understand the eligibility criteria:

- Property Location: The property must be located in a designated USDA-eligible rural area. The USDA Loan Map can be used to verify eligibility.

- Income Limits: Borrowers must meet specific income limits based on the size of their household and the location of the property. These limits vary by county and are readily available on the USDA website.

- Credit History: Borrowers need to demonstrate a reasonable credit history, although the USDA program offers more flexibility compared to conventional loans.

- Homeownership Status: Borrowers must be first-time homebuyers or meet specific criteria to qualify for a USDA loan.

- Property Type: The property must be a single-family home, a condominium, or a manufactured home meeting specific requirements.

- Intended Use: The property must be for the borrower’s primary residence, not for investment purposes.

The Application Process: A Step-by-Step Guide

The application process for a USDA loan involves several steps:

- Pre-Qualification: Potential borrowers should contact a USDA-approved lender to obtain pre-qualification, which involves a preliminary assessment of their eligibility based on their financial situation.

- Property Search: Once pre-qualified, borrowers can begin searching for suitable properties in USDA-eligible areas.

- Loan Application: After selecting a property, borrowers submit a formal loan application to the chosen USDA-approved lender.

- Loan Approval: The lender reviews the application and supporting documentation, including credit history, income verification, and property appraisal.

- Loan Closing: Once the loan is approved, borrowers attend a closing meeting with the lender and other parties involved in the transaction to finalize the purchase.

Tips for Success: Maximizing Your Chances of Approval

- Check Your Credit Score: Ensure your credit score meets the USDA’s requirements.

- Maintain Stable Income: Demonstrate a steady income history to support your ability to repay the loan.

- Save for a Down Payment: While a 0% down payment is possible, saving for a small down payment can improve your loan terms.

- Shop Around for Lenders: Compare loan terms and rates from multiple USDA-approved lenders to find the best option.

- Consult with a Real Estate Agent: An experienced real estate agent can guide you through the property search process and provide valuable insights.

Frequently Asked Questions (FAQs)

Q: What is the maximum loan amount for a USDA loan?

A: The maximum loan amount for a USDA loan varies by location and is based on the median home value in the area. However, there are limits on the maximum loan amount, typically ranging from $250,000 to $400,000.

Q: How do I find a USDA-approved lender?

A: The USDA website provides a searchable directory of approved lenders. You can also contact your local USDA Rural Development office for assistance.

Q: What are the closing costs associated with a USDA loan?

A: Closing costs for USDA loans can vary depending on the lender and the specific loan terms. However, they are generally lower than those associated with conventional loans.

Q: Can I use a USDA loan to purchase a fixer-upper?

A: Yes, USDA loans can be used to purchase fixer-upper properties, but they must meet specific requirements for rehabilitation and must be appraised at their market value after the repairs are completed.

Q: How long does the USDA loan application process take?

A: The application process can take anywhere from 30 to 60 days, depending on the complexity of the loan and the borrower’s financial situation.

Conclusion: Unlocking Homeownership Opportunities in Rural Ohio

The USDA loan program offers a valuable tool for individuals seeking to purchase homes in eligible rural areas of Ohio. By providing lower down payment requirements, competitive interest rates, and flexible credit criteria, USDA loans can make homeownership more attainable for a wider range of borrowers. Understanding the program’s eligibility criteria, application process, and benefits is crucial for anyone considering a USDA loan. With careful planning and preparation, individuals can navigate the program effectively and unlock the opportunity to build a future in a vibrant and thriving rural community.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Rural Homeownership in Ohio: Understanding USDA Loan Eligibility. We thank you for taking the time to read this article. See you in our next article!