Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia

Related Articles: Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia

- 2 Introduction

- 3 Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia

- 3.1 Deciphering the USDA Loan Eligibility Map: A Visual Guide to Opportunity

- 3.2 Beyond the Map: Key Eligibility Criteria for USDA Loans in Georgia

- 3.3 Benefits of Utilizing USDA Loans in Georgia: Building a Strong Foundation

- 3.4 Navigating the Application Process: Steps to Success

- 3.5 FAQs Regarding USDA Loans in Georgia: Addressing Common Concerns

- 3.6 Tips for Success: Maximizing Your Chances of Approval

- 3.7 Conclusion: Empowering Rural Communities through USDA Loans

- 4 Closure

Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia

The United States Department of Agriculture (USDA) offers a variety of loan programs designed to promote rural development and economic growth. One of the most impactful programs is the Rural Development Loan program, which provides financial assistance to individuals and businesses seeking to purchase, build, or improve homes and properties in eligible rural areas. Understanding the USDA loan eligibility map for Georgia is crucial for potential borrowers seeking to leverage these resources.

Deciphering the USDA Loan Eligibility Map: A Visual Guide to Opportunity

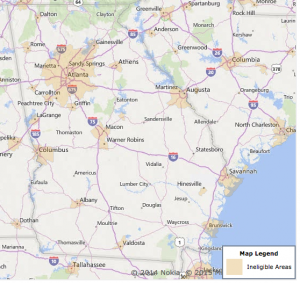

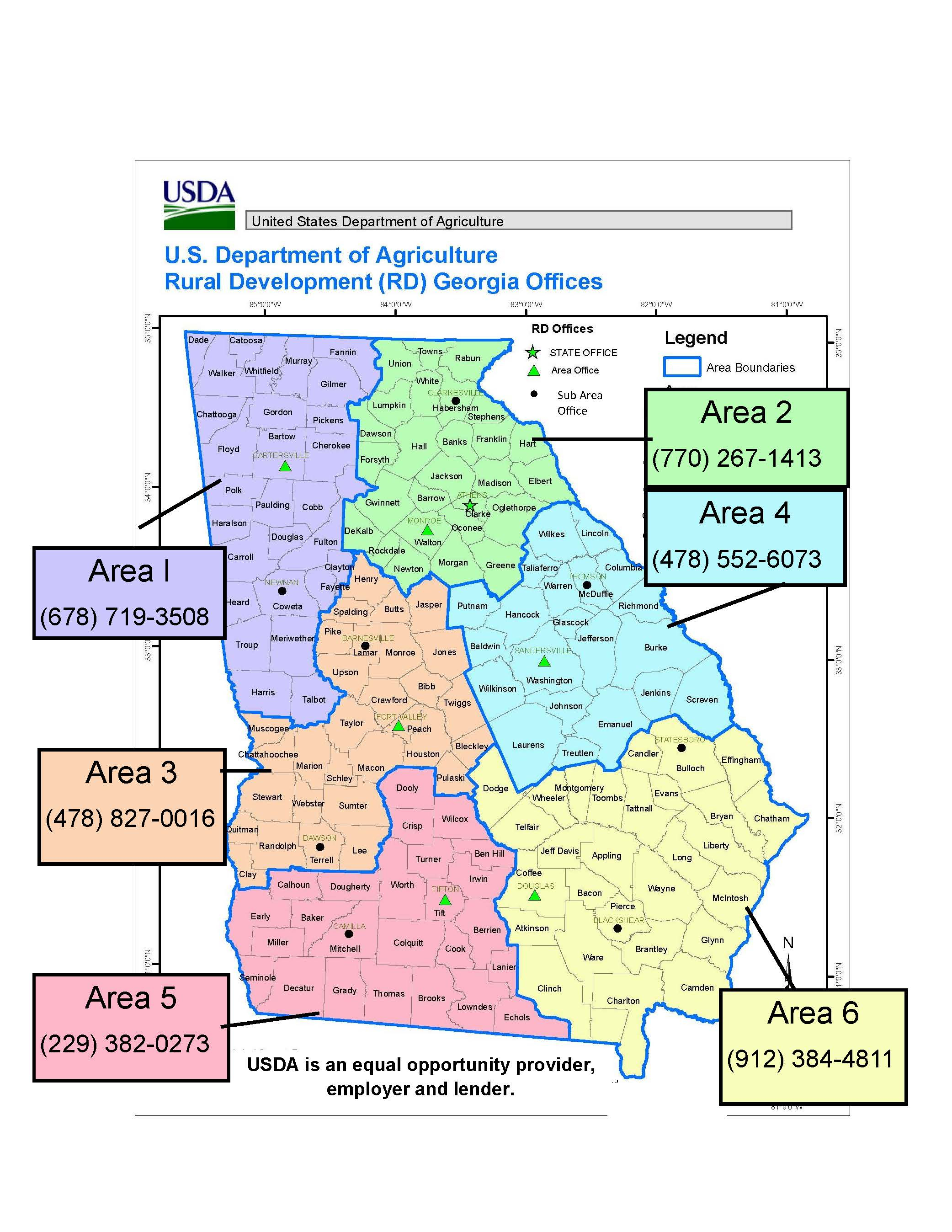

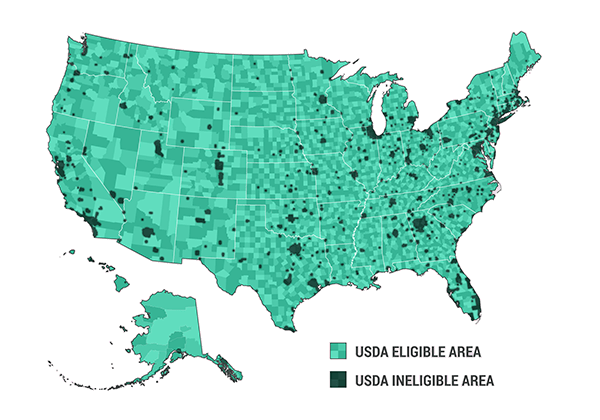

The USDA loan eligibility map is a powerful tool that visually depicts areas in Georgia eligible for USDA loan programs. This map serves as a starting point for potential borrowers, allowing them to quickly determine if their desired location qualifies for financing. It is important to note that the map does not guarantee loan approval, as eligibility is based on a multi-faceted assessment. However, it provides a clear understanding of the geographic scope of USDA loan programs.

Key Features of the USDA Loan Eligibility Map:

- Color-Coded Regions: The map typically utilizes different colors to differentiate between eligible and ineligible areas. Green or blue often represent eligible rural areas, while red or yellow may indicate ineligible urban zones.

- Detailed Boundaries: The map displays precise boundaries of eligible areas, encompassing both urban and rural communities within Georgia.

- Interactive Capabilities: Many online versions of the map offer interactive features, allowing users to zoom in on specific areas, search by address, and obtain detailed information about eligibility criteria.

Beyond the Map: Key Eligibility Criteria for USDA Loans in Georgia

While the USDA loan eligibility map provides a visual overview, it is essential to understand the specific eligibility criteria that govern loan approval. These criteria encompass various aspects, including:

- Location: The property must be located in a designated rural area within Georgia, as defined by the USDA.

- Income Limits: Borrowers must meet specific income limitations based on household size and location. These limits are designed to prioritize assistance for lower- and moderate-income individuals and families.

- Credit History: A satisfactory credit history is typically required, demonstrating the borrower’s ability to manage financial obligations responsibly.

- Property Type: Eligibility extends to various property types, including single-family homes, multi-family units, manufactured homes, and rural businesses.

- Loan Purpose: The loan must be used for a specific purpose, such as purchasing, building, or improving a home, or for business expansion or development.

Benefits of Utilizing USDA Loans in Georgia: Building a Strong Foundation

Securing a USDA loan can offer significant advantages for individuals and businesses seeking to establish or improve their presence in rural Georgia. Some of the key benefits include:

- Lower Interest Rates: USDA loans often carry lower interest rates compared to conventional mortgages, potentially saving borrowers thousands of dollars over the loan term.

- Flexible Payment Options: The program offers flexible repayment options, including fixed and adjustable-rate mortgages, tailored to individual needs and financial situations.

- Affordable Housing Solutions: USDA loans are designed to provide affordable housing options, making homeownership more accessible to a wider range of individuals and families.

- Rural Economic Development: By supporting homeownership and business development in rural areas, USDA loans contribute to the overall economic growth and prosperity of Georgia’s rural communities.

Navigating the Application Process: Steps to Success

Applying for a USDA loan in Georgia involves a series of steps designed to ensure thorough evaluation and responsible lending practices. The following steps outline the general process:

- Pre-Qualification: Begin by contacting a USDA-approved lender to discuss your financial situation and determine your pre-qualification status.

- Credit Check and Income Verification: The lender will conduct a credit check and verify your income to assess your financial capacity.

- Property Appraisal: A qualified appraiser will assess the value of the property to ensure it meets USDA standards and fair market value.

- Loan Application and Documentation: Submit a complete loan application with all required supporting documentation, including income verification, credit history, and property details.

- Loan Approval and Closing: Upon approval, the lender will provide you with the loan terms and guide you through the closing process.

FAQs Regarding USDA Loans in Georgia: Addressing Common Concerns

1. What is the maximum loan amount available through USDA programs?

The maximum loan amount varies depending on the specific program and property location. It is recommended to contact a USDA-approved lender for detailed information.

2. Are there any closing costs associated with USDA loans?

Yes, there are typically closing costs associated with USDA loans, similar to conventional mortgages. These costs can include appraisal fees, title insurance, and recording fees.

3. What is the difference between a USDA direct loan and a USDA guaranteed loan?

USDA direct loans are funded directly by the USDA, while USDA guaranteed loans are provided by private lenders with a guarantee from the USDA. The eligibility criteria and terms may differ between the two programs.

4. Can I use a USDA loan to purchase a property for rental purposes?

USDA loans are primarily intended for owner-occupied properties. However, certain programs may allow for limited rental situations, such as multi-family units.

5. How can I find a USDA-approved lender in Georgia?

The USDA website provides a list of approved lenders in Georgia. You can also contact your local real estate agent or mortgage broker for recommendations.

Tips for Success: Maximizing Your Chances of Approval

1. Start Early: Begin the loan application process well in advance to allow ample time for credit checks, income verification, and property appraisal.

2. Improve Your Credit Score: A higher credit score can significantly improve your chances of loan approval and potentially secure a lower interest rate.

3. Gather Necessary Documentation: Organize all required documentation, including income verification, credit history, and property details, to streamline the application process.

4. Work with a Reputable Lender: Choose a USDA-approved lender with a proven track record of assisting borrowers in rural areas.

5. Understand the Terms and Conditions: Carefully review the loan terms and conditions before signing any agreements to ensure you fully understand your obligations.

Conclusion: Empowering Rural Communities through USDA Loans

The USDA loan eligibility map for Georgia provides a valuable resource for individuals and businesses seeking to access affordable financing in rural areas. By understanding the map and the associated eligibility criteria, potential borrowers can make informed decisions about their housing and business ventures. Utilizing USDA loans offers numerous benefits, including lower interest rates, flexible payment options, and support for rural economic development. By navigating the application process thoughtfully and adhering to best practices, individuals and businesses can maximize their chances of securing these valuable resources and contributing to the growth and prosperity of Georgia’s rural communities.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Opportunities: Understanding the USDA Loan Eligibility Map in Georgia. We thank you for taking the time to read this article. See you in our next article!